The geopolitics of energy has once again taken center stage, with the United States appearing to adopt a selective approach toward countries importing Russian oil. While Washington has consistently raised objections to India’s rising imports of Russian crude, China—despite being Moscow’s largest energy buyer—has faced noticeably less criticism. This double standard has triggered strong reactions globally, and recently, US Senator Marco Rubio weighed in on the matter, questioning why the Biden administration seems to be sparing China while training its spotlight on India.

Rubio’s comments reflect growing unease in Washington about the credibility of US foreign policy, especially as it relates to energy security, trade balances, and global alliances. His remarks also highlight the delicate balancing act between strategic competition with China and strategic partnership with India—two vastly different relationships for the United States.

US-India Tensions Over Russian Oil

India, the world’s third-largest oil importer, has significantly increased purchases of discounted Russian crude since the imposition of Western sanctions following the Ukraine war. The reasoning is straightforward—India needs affordable energy to fuel its 1.4 billion-strong population and growing economy.

However, US officials have repeatedly expressed concern over India’s stance, arguing that such imports indirectly aid Russia in sustaining its war machine. Despite these criticisms, New Delhi has maintained that its energy purchases are dictated purely by national interest and economic pragmatism.

- India imports over 80% of its crude oil needs.

- Russian oil rose from 2% of India’s crude imports in 2021 to over 40% in 2023–24.

- Refiners in India have turned Russian crude into diesel and other products, some of which may have found their way to Western markets.

Rubio pointed out that while the US administration has publicly pressured India, it has refrained from taking a similarly strong position against China, even though Beijing is Moscow’s largest oil customer.

China’s Russian Oil Strategy

China’s energy strategy differs from India’s but has equally significant implications for the global oil market.

- China imports close to 2 million barrels per day (bpd) from Russia, more than any other country.

- Russian oil now accounts for over 20% of China’s total crude imports.

- Beijing pays Moscow in yuan, a strategic move that undermines the dominance of the US dollar in global energy trade.

Despite this, Washington has largely avoided targeting Beijing directly, a move that many analysts believe stems from America’s complex economic interdependence with China.

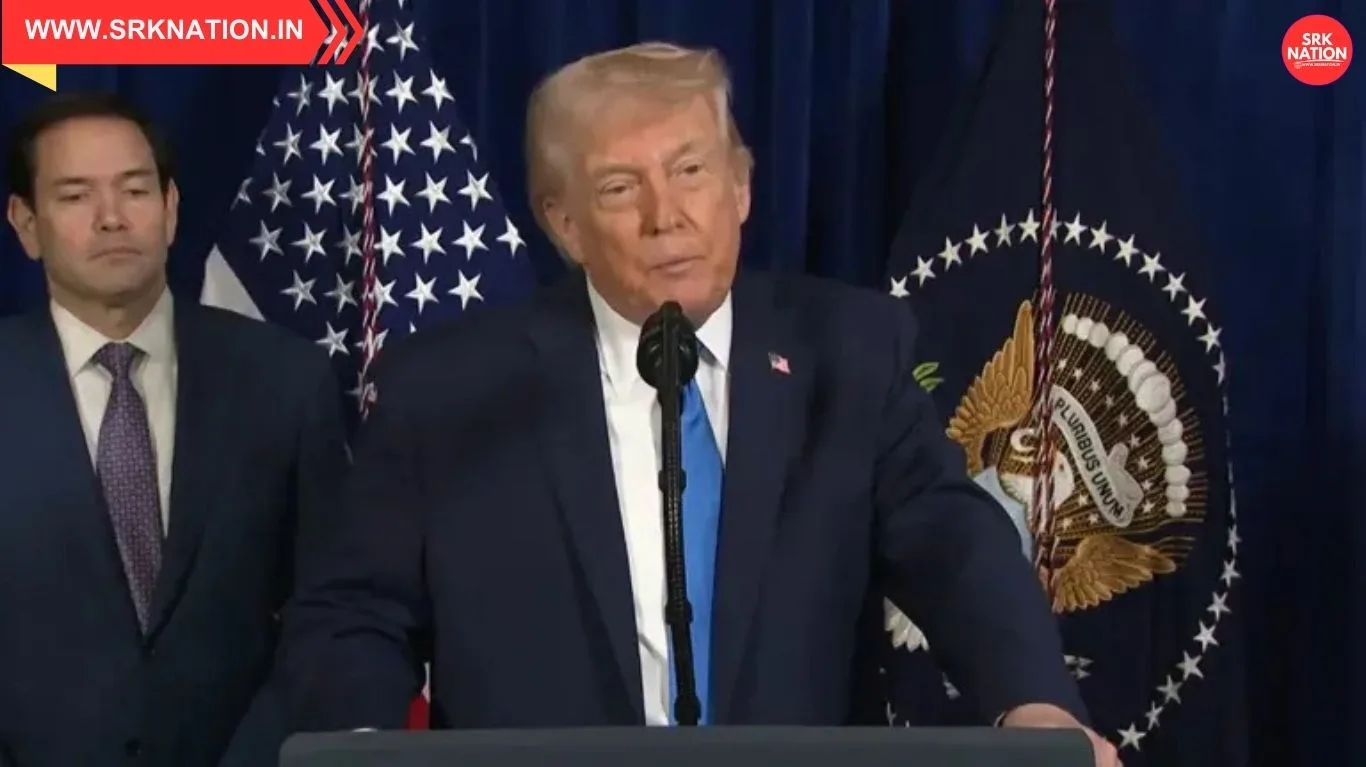

Marco Rubio’s Criticism

Rubio, known for his hawkish stance on China, did not mince words. He argued that the Biden administration’s approach was “absolutely inconsistent” and could erode Washington’s credibility with partners like India. According to Rubio:

- Targeting India while sparing China sends the wrong message.

- Washington risks alienating a key ally in its Indo-Pacific strategy.

- China’s purchase of Russian oil has far greater consequences for US interests than India’s imports.

Rubio emphasized that while India’s actions are rooted in survival and economic stability, China’s imports are geopolitical by design, aimed at creating an alternative financial ecosystem that reduces reliance on the US dollar.

Why the US Might Be Treating India and China Differently

Analysts highlight several reasons why Washington may be sparing China:

- Economic Interdependence

- US-China trade exceeded $575 billion in 2023.

- Washington fears that sanctioning Beijing on energy could spark retaliation affecting American businesses and consumers.

- Leverage vs Partnership

- The US views India as a strategic partner in countering China’s rise.

- Applying pressure on New Delhi is seen as more feasible, while confrontation with Beijing could spiral into full-scale economic warfare.

- Dollar Dominance Threat

- China’s payments for Russian oil in yuan directly challenge the petrodollar system.

- Washington is cautious about escalating this trend by overreacting to Beijing’s purchases.

- Geopolitical Optics

- Criticizing India allows the US to show consistency in sanction enforcement.

- At the same time, sparing China avoids worsening already fragile US-China ties.

Comparative Data: India vs China in Russian Oil Imports

| Country | Avg. Russian Oil Imports (2024) | Share of Total Imports | Payment Mechanism | US Response |

|---|---|---|---|---|

| India | ~1.7 million bpd | ~40% | USD, Dirham, alternatives | Public pressure, diplomatic nudges |

| China | ~2.0 million bpd | ~20–22% | Yuan settlements | Mild statements, no direct action |

The data makes Rubio’s point clear—China’s imports are higher and strategically more damaging, yet India has been the one facing disproportionate scrutiny.

India’s Position

India has defended its energy strategy on multiple occasions:

- External Affairs Minister S. Jaishankar has reiterated that “India will do what is best for India’s energy security.”

- Indian officials argue that energy affordability is critical for growth, especially when global oil prices remain volatile.

- India also stresses that it abides by the price cap mechanism agreed upon by G7 countries, ensuring that Moscow’s profits remain restricted.

India views the criticism as unfair targeting, given that Europe itself bought significant amounts of Russian energy until recently.

Global Implications

The divergence in US treatment of India and China has broader consequences:

- Trust Deficit with India: Washington risks straining its growing strategic partnership with New Delhi.

- Boost for China: The lack of pushback enables Beijing to strengthen its yuan-based trade networks.

- Fragmented Sanctions Regime: Uneven enforcement weakens the credibility of Western sanctions.

- Geopolitical Realignment: Emerging economies may interpret this as another example of the West applying double standards in global governance.

Expert Views

- Energy Analysts argue that India’s purchases are a pragmatic necessity, while China’s strategy poses a structural threat to Western influence.

- Geopolitical Experts note that Rubio’s comments reflect bipartisan concerns in Washington that sparing China could undermine long-term US goals.

- Market Observers highlight that oil markets remain volatile, and any US action against China could spike global prices, which the White House wants to avoid ahead of elections.

Outlook

Rubio’s intervention may add pressure on the Biden administration to clarify its stance. If Washington continues to disproportionately target India while sparing China, the long-term cost could be the erosion of US credibility in the Indo-Pacific coalition.

For India, the path forward remains clear—it will continue to pursue energy security in line with its national interests, while balancing diplomatic engagements with the West. For China, the benefits of being spared scrutiny further strengthen its ambition to reshape the global financial order.

Ultimately, as Rubio highlighted, the US risks sending a dangerous signal: that it is willing to confront its partners, but hesitant to challenge its rivals.

Disclaimer: This article is based on expert commentary, public statements, and geopolitical analysis. It is intended for informational purposes only and should not be treated as official policy advice.