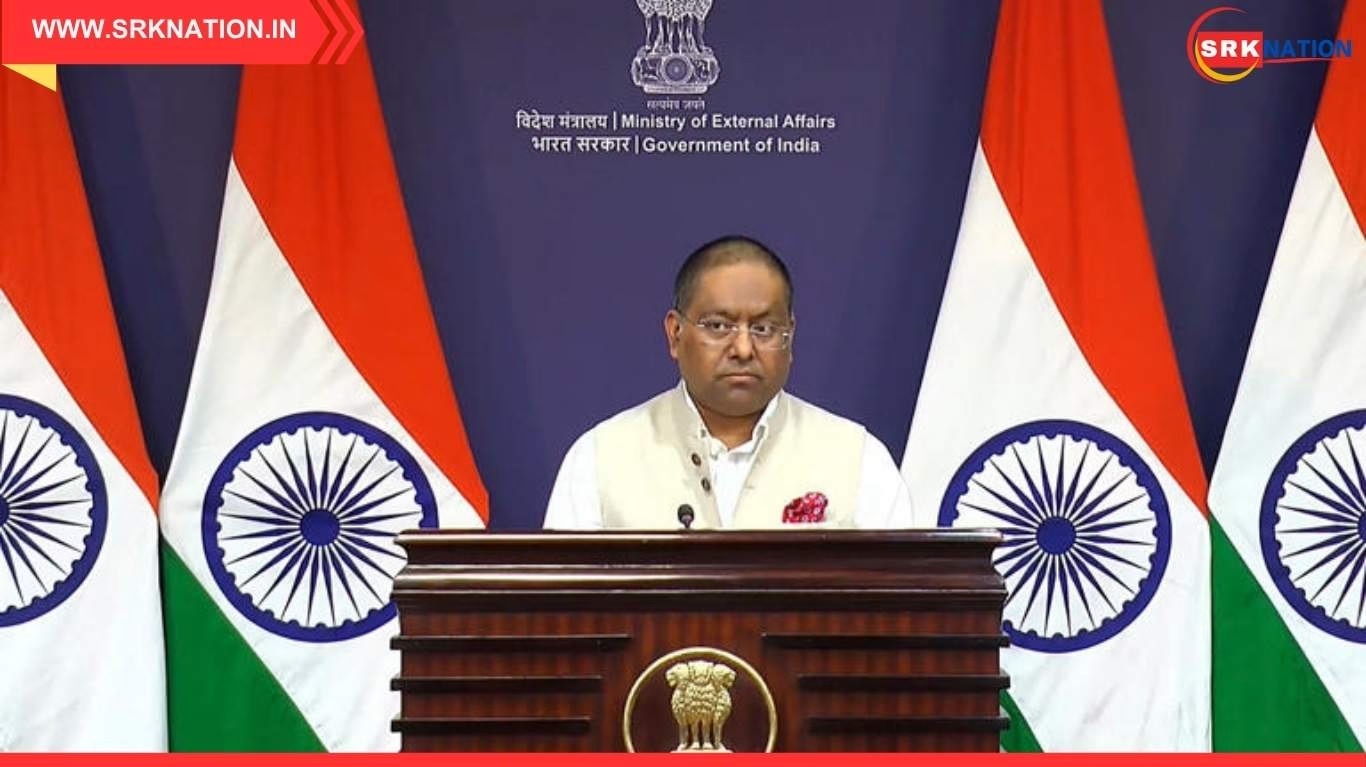

India has officially stated that it is “studying the implications” of the recent US sanctions imposed on Russian oil giants Rosneft and Lukoil, while reiterating that its energy decisions are guided by the imperative to secure affordable and reliable supplies for its population of 1.4 billion. The announcement was made by Ministry of External Affairs (MEA) spokesperson Randhir Jaiswal during a press briefing in New Delhi on October 30, 2025, amid growing global scrutiny over India’s continued oil imports from Russia.

The sanctions, part of Washington’s intensified economic pressure campaign against Moscow over its ongoing war in Ukraine, have raised concerns about potential disruptions in India’s crude supply chain. However, India has maintained a firm stance that its energy policy is shaped by national interest and market dynamics—not geopolitical alignments.

🧠 India’s Official Response to US Sanctions

| Statement Date | MEA Spokesperson | Key Message |

|---|---|---|

| October 30, 2025 | Randhir Jaiswal | “We are studying the implications of the recent US sanctions on Russian oil companies. Our decisions naturally take into account the evolving dynamics of the global market.” |

Jaiswal emphasized that India’s energy sourcing remains rooted in affordability, diversity, and security, adding that “our position on the larger question of energy sourcing is well known.”

🛢️ Overview of US Sanctions on Russian Oil Firms

| Sanctioned Entities | Date of Sanction | Impact on Global Market |

|---|---|---|

| Rosneft PJSC | October 23, 2025 | Disruption in supply chains, risk of secondary sanctions |

| Lukoil PJSC | October 23, 2025 | Increased compliance pressure on global refiners and shippers |

The sanctions include restrictions on financial transactions, shipping, and insurance services linked to Russian oil exports, making it harder for Indian refiners to continue business as usual.

📊 India’s Oil Import Profile (2024–2025)

| Source Country | Share of Total Imports | Key Suppliers |

|---|---|---|

| Russia | 32% | Rosneft, Lukoil |

| Iraq | 20% | SOMO |

| Saudi Arabia | 18% | Aramco |

| UAE | 10% | ADNOC |

| US | 7% | ExxonMobil, Chevron |

Russia has emerged as India’s top crude supplier since 2022, offering discounted rates that helped cushion domestic fuel prices.

🧭 Strategic Considerations for India

| Factor | Implication for Policy |

|---|---|

| Energy Security | Must ensure uninterrupted supply for domestic consumption |

| Price Stability | Russian crude offers cost advantage amid volatile global prices |

| Refining Margins | Cheaper imports boost profitability for Indian refiners |

| Geopolitical Neutrality | India avoids taking sides in global conflicts |

India’s energy strategy is built on pragmatism, balancing diplomatic relations with economic imperatives.

🗣️ Global Reactions and Diplomatic Signals

| Country/Entity | Position on India’s Oil Imports |

|---|---|

| United States | Urged reduction in Russian oil purchases |

| European Union | Monitoring compliance with sanctions |

| Russia | Reaffirmed commitment to supply India |

| OPEC+ | Concerned about market volatility |

While the US has praised India’s “good behavior” on reducing Russian oil imports, it continues to push for further alignment with Western sanctions.

📉 Potential Impact on Indian Refiners

| Refiner Name | Exposure to Russian Crude | Risk Level |

|---|---|---|

| Indian Oil Corporation | High | Moderate |

| Reliance Industries | High | High |

| Bharat Petroleum | Medium | Low |

| Hindustan Petroleum | Low | Minimal |

Private refiners like Reliance may face higher compliance risks due to global financing and shipping dependencies.

📌 Conclusion

India’s measured response to US sanctions on Russian oil firms reflects its commitment to safeguarding national energy interests while navigating complex geopolitical terrain. As the world’s third-largest oil consumer, India’s decisions carry significant weight in global energy markets. With the needs of 1.4 billion people at the core of its policy, India will continue to prioritize affordability, access, and strategic autonomy in its energy sourcing.

Disclaimer: This article is based on publicly available government statements and news reports. It does not constitute policy advice or diplomatic analysis. All views are for informational purposes only.