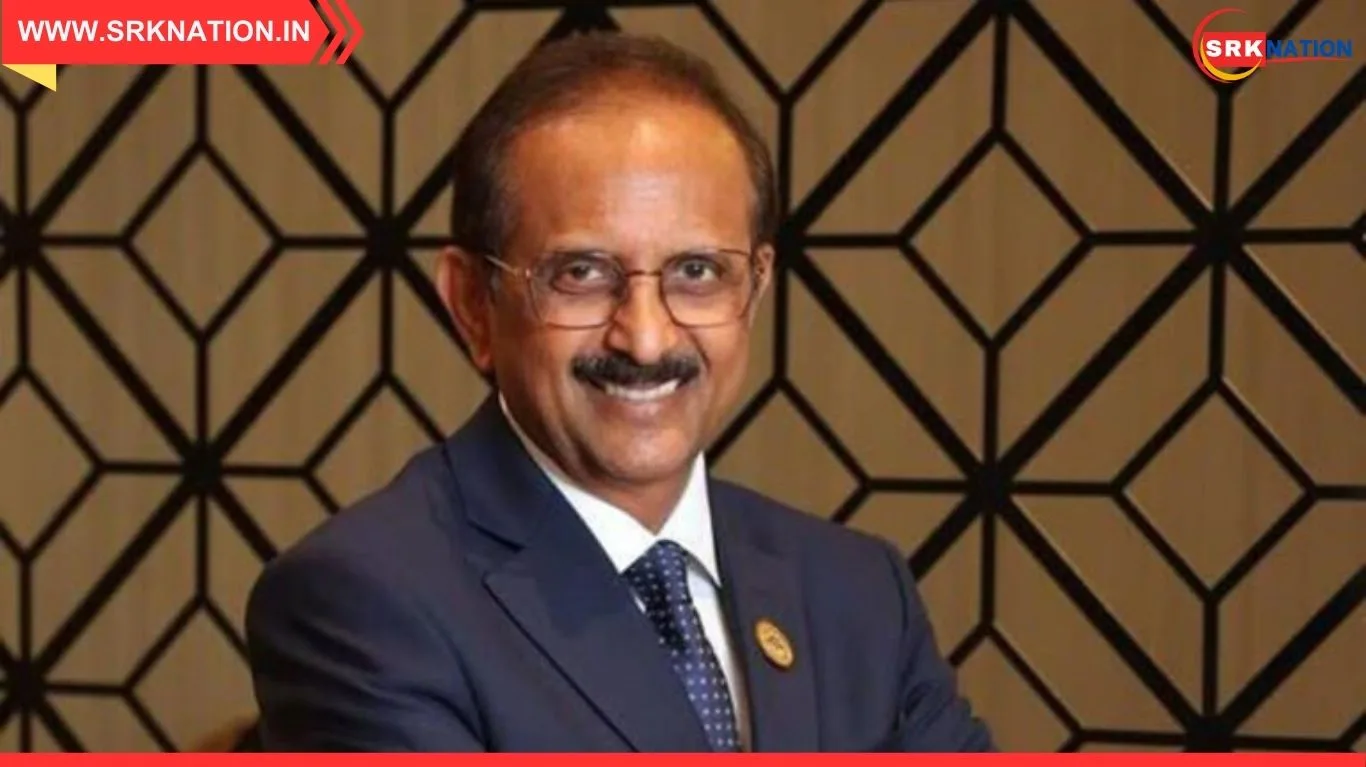

India’s largest lender, the State Bank of India (SBI), has expressed confidence that consumption demand in the country will remain resilient in the coming quarters. Chairman CS Setty highlighted that despite global uncertainties and inflationary pressures, India’s domestic consumption story continues to be strong, driven by rising incomes, urbanization, and government-led infrastructure spending. His remarks come at a time when policymakers and businesses are closely monitoring demand trends to gauge the health of the economy.

Background of the Statement

- CS Setty emphasized that India’s consumption demand is supported by structural factors such as demographics, rising middle-class aspirations, and digital adoption.

- He noted that while global economies are facing headwinds, India’s domestic market remains robust.

- The banking sector, particularly SBI, plays a pivotal role in financing consumption and investment, making its outlook significant for the broader economy.

- The statement reflects optimism about India’s ability to sustain growth momentum even amid external challenges.

Key Drivers of Sustained Consumption Demand

| Driver | Details | Impact on Economy |

|---|---|---|

| Rising Incomes | Growth in salaries and wages across sectors | Boosts household spending |

| Urbanization | Expansion of cities and towns | Increases demand for housing, retail, services |

| Government Spending | Infrastructure and welfare programs | Stimulates consumption indirectly |

| Digital Adoption | E-commerce, fintech, digital payments | Expands access to goods and services |

| Demographics | Young population with aspirational needs | Sustains long-term demand |

Sectoral Outlook

| Sector | Consumption Trend | Outlook |

|---|---|---|

| FMCG & Retail | Strong demand in urban and rural areas | Positive growth trajectory |

| Automobiles | Rising sales of passenger vehicles and EVs | Sustained momentum expected |

| Housing & Real Estate | Increased demand for affordable housing | Supported by government schemes |

| Banking & Financial Services | Higher credit demand for retail loans | Healthy loan growth |

| Travel & Hospitality | Surge in domestic tourism | Continued expansion |

SBI’s Role in Supporting Consumption

- SBI has expanded its retail loan portfolio, catering to housing, automobiles, and personal loans.

- The bank has leveraged digital platforms to reach customers across urban and rural markets.

- By financing consumption, SBI contributes directly to sustaining demand in the economy.

- The bank’s confidence reflects its strong balance sheet and ability to manage risks.

Expert Reactions

- Economists: Agree that India’s consumption demand is structurally strong, though caution about inflationary risks.

- Industry leaders: Highlight the role of government policies in sustaining demand.

- Market analysts: Note that banking sector growth is closely tied to consumption trends.

- Investors: View SBI’s optimism as a positive signal for equity markets.

Challenges Ahead

- Inflation: Rising prices could impact household budgets.

- Global Uncertainty: Slowdowns in major economies may affect exports and investment flows.

- Rural Demand: Dependent on monsoon and agricultural performance.

- Credit Risks: Banks must manage retail loan growth carefully to avoid defaults.

Comparative Analysis: India vs Global Consumption Trends

| Country/Region | Consumption Outlook | Key Factors |

|---|---|---|

| India | Sustained demand | Demographics, rising incomes, government spending |

| United States | Moderated demand | Inflation, interest rates |

| China | Mixed outlook | Property sector slowdown, government stimulus |

| Europe | Weak demand | Energy costs, geopolitical tensions |

| Emerging Markets | Varied | Dependent on local policies and global trade |

India’s consumption resilience stands out compared to global peers, reinforcing optimism about its growth trajectory.

Strategic Importance of Consumption Demand

- Consumption accounts for nearly 60% of India’s GDP, making it the backbone of economic growth.

- Sustained demand ensures stability in industries ranging from FMCG to real estate.

- Strong consumption trends attract foreign investment, boosting India’s global economic standing.

- Policymakers rely on consumption data to frame fiscal and monetary policies.

Lessons for Businesses

- Focus on affordability: Products and services must cater to diverse income groups.

- Leverage digital platforms: E-commerce and fintech are critical for reaching consumers.

- Invest in rural markets: Rural demand remains a significant growth driver.

- Adapt to changing preferences: Sustainability and innovation are increasingly valued by consumers.

Broader Economic Context

- India’s economy continues to grow at one of the fastest rates globally.

- Consumption demand is complemented by government-led infrastructure spending and private investment.

- The resilience of domestic demand provides a cushion against global volatility.

- SBI’s outlook reflects confidence in India’s ability to sustain growth momentum.

Conclusion

CS Setty’s statement that “consumption demand is likely to be sustained” reflects optimism about India’s economic resilience. With rising incomes, demographic advantages, and government support, India’s consumption story remains strong. While challenges such as inflation and global uncertainties persist, the structural drivers of demand provide confidence for the future. For businesses, policymakers, and investors, the message is clear: India’s consumption-led growth is here to stay, and institutions like SBI will continue to play a pivotal role in supporting this momentum.

Disclaimer

This article is intended for informational purposes only and does not constitute financial or economic advice. Market conditions, consumption trends, and banking strategies are subject to change based on evolving circumstances. Readers are encouraged to consult experts and official reports for accurate information. The author and publisher are not responsible for any decisions made based on this article.