The United States has officially issued a notice confirming the imposition of a steep 50% tariff on Indian imports, set to take effect from 12:01 AM EST on August 27, 2025. The move, authorized under Executive Order 14329 signed by President Donald Trump on August 6, doubles the existing 25% tariff rate and marks a significant escalation in trade tensions between Washington and New Delhi.

The notice, published by the Department of Homeland Security through US Customs and Border Protection (CBP), targets Indian goods “entered for consumption, or withdrawn from warehouse for consumption” after the deadline. The White House has framed the decision as part of a broader strategy to pressure Russia by penalizing its oil trade partners, with India being one of the largest importers of discounted Russian crude.

🧭 Timeline of Tariff Escalation and Diplomatic Fallout

| Date | Event Description | Impact on Bilateral Relations |

|---|---|---|

| August 6, 2025 | Trump signs Executive Order 14329 | Authorizes 50% tariff on Indian imports |

| August 21, 2025 | US publishes draft notice via CBP | Confirms implementation timeline |

| August 25, 2025 | PM Modi addresses public in Ahmedabad | Reaffirms India’s stance on Russian oil |

| August 27, 2025 | Tariffs set to take effect | Trade disruption expected |

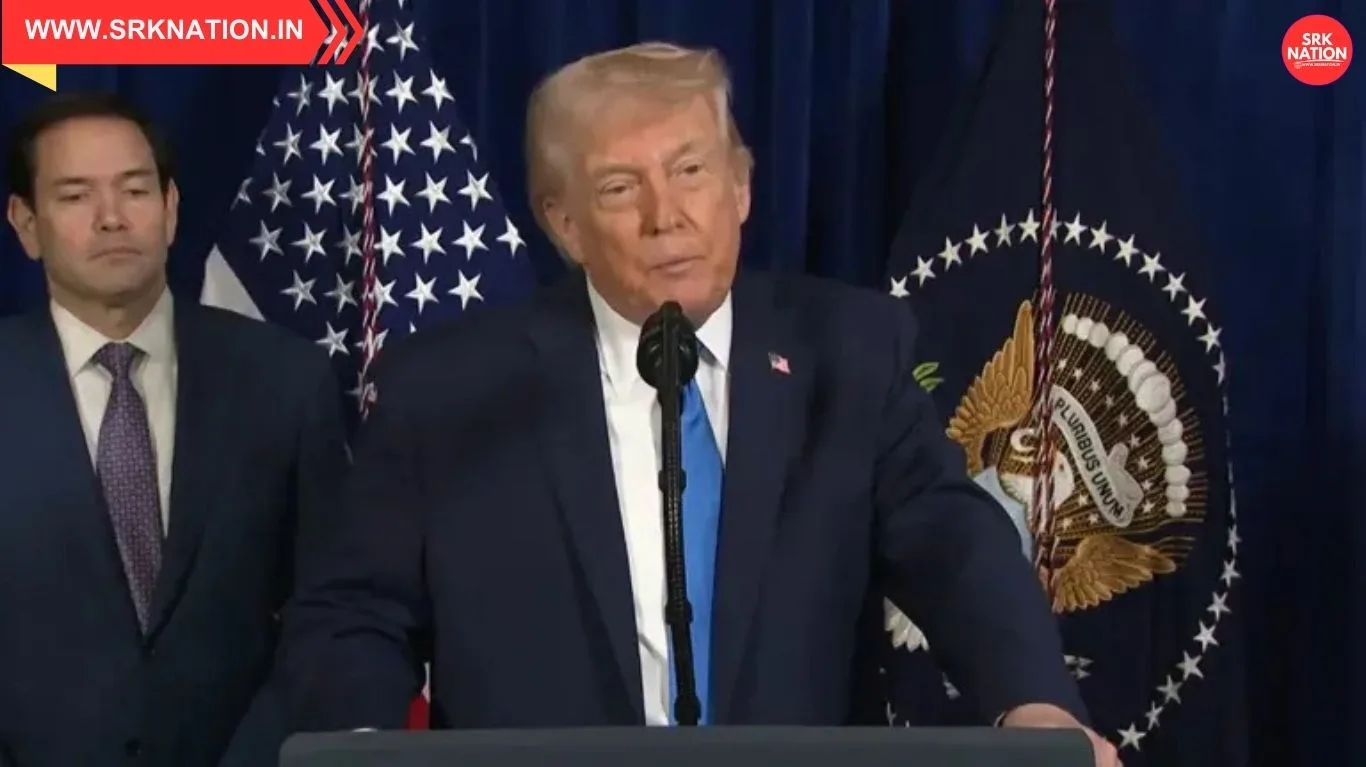

President Trump has ruled out further trade negotiations with India until the current dispute is resolved, stating, “No, not until we get it resolved,” when asked about future talks.

📊 Scope and Impact of the 50% Tariff on Indian Exports

| Sector Affected | Estimated Export Value (FY25) | Vulnerability Level |

|---|---|---|

| Gems and Jewelry | $42 billion | High |

| Textiles and Apparel | $16 billion | High |

| Seafood and Agriculture | $7.5 billion | Moderate |

| Pharmaceuticals | $24 billion | Low to Moderate |

| Auto Components | $5.2 billion | Moderate |

The new tariff regime is expected to hit low-margin, labor-intensive sectors the hardest, particularly small exporters who rely on competitive pricing to maintain market share in the US.

🔍 US Justification: Targeting Russian Oil Trade

The White House has justified the tariff hike as a “secondary sanction” aimed at curbing Russia’s oil revenues. India, which sources nearly a third of its crude from Russia, has defended its energy strategy as essential for domestic price stability and national interest.

| US Argument | India’s Response |

|---|---|

| India fueling Ukraine war | India calls claim “unfair and unjustified” |

| Tariffs to pressure Putin | India says oil imports are sovereign right |

| No trade talks until resolved | India urges diplomatic dialogue |

The US has warned of “very big consequences” for countries continuing trade with Moscow, though major importers like China have so far avoided similar penalties.

🧠 PM Modi’s Response: “No Matter How Much Pressure Comes…”

Prime Minister Narendra Modi, speaking in Ahmedabad on August 25, reaffirmed India’s commitment to protecting farmers, small businesses, and economic sovereignty. “No matter how much pressure comes, we will keep increasing our strength to withstand it,” he declared.

| Modi’s Key Statements | Policy Implications |

|---|---|

| “Your interests are paramount for Modi” | Focus on MSME protection |

| “Buy only made-in-India goods” | Push for swadeshi movement |

| “We will bear economic pressure” | Signals resilience against external coercion |

Modi also urged traders to display boards outside their shops declaring they sell only Indian-made products, echoing Mahatma Gandhi’s call for economic self-reliance.

📉 Trade Relations: From Strategic Partnership to Tariff War

The tariff escalation marks a dramatic shift in US-India trade relations, which had seen steady growth in recent years. Bilateral trade crossed $190 billion in FY24, with the US being India’s largest export destination.

| Year | Bilateral Trade Volume | Trade Balance (India’s Favor) |

|---|---|---|

| FY22 | $146 billion | $32 billion |

| FY23 | $172 billion | $38 billion |

| FY24 | $190 billion | $41 billion |

| FY25 (est.) | $195 billion | At risk due to tariffs |

The new tariffs could reverse gains made under previous trade dialogues and impact India’s export competitiveness in the US market.

🧠 Strategic Implications and Global Reactions

India’s continued purchase of Russian oil has drawn criticism from Western allies, but New Delhi has maintained that its energy policy is guided by affordability and strategic autonomy. The US move may also influence other countries to reassess their trade ties with Russia.

| Country | Position on India’s Oil Trade with Russia | Likely Reaction to US Tariffs |

|---|---|---|

| China | Continues imports, no penalties | Likely silent |

| EU | Mixed stance, some member states critical | May support US pressure |

| Japan | Strategic partner, cautious approach | Diplomatic balancing |

| UAE | Neutral, maintains trade with both sides | Unlikely to intervene |

India has called for a multilateral approach to resolving the Ukraine crisis, emphasizing diplomacy over economic coercion.

📌 Conclusion

With the US formally notifying its intent to impose 50% tariffs on Indian imports starting August 27, the countdown to a major trade disruption has begun. While Washington frames the move as a geopolitical lever against Russia, New Delhi views it as an unjustified penalty that undermines economic sovereignty.

As Prime Minister Modi rallies domestic support and urges a swadeshi push, the B2B and export sectors brace for turbulence. Whether diplomacy can defuse the tariff bomb remains to be seen, but the episode underscores the fragile balance between strategic autonomy and global interdependence.

—

Disclaimer: This article is based on publicly available news reports and official statements as of August 26, 2025. It is intended for informational purposes only and does not constitute financial, legal, or diplomatic advice.