Radico Khaitan Ltd has reported a 70.8% jump in consolidated net profit, reaching ₹92.07 crore for the fourth quarter of FY25, driven by strong volume growth and premiumization efforts.

Financial Highlights

- Revenue from operations rose 15.16% YoY to ₹4,485.42 crore, compared to ₹3,894.63 crore in Q4FY24.

- Total IMFL (Indian Made Foreign Liquor) volume increased 27.9%, reaching 9.15 million cases.

- Prestige & Above brands contributed 39.1% to total IMFL volumes, with a 16.8% growth.

- Total expenses rose 14.26% to ₹4,365.37 crore, reflecting higher operational costs.

FY25 Performance & Future Outlook

- Annual net profit surged 31.8% YoY to ₹345.61 crore, marking Radico Khaitan’s strongest financial results to date.

- Total consolidated income for FY25 stood at ₹17,103.38 crore, crossing the $2 billion revenue milestone.

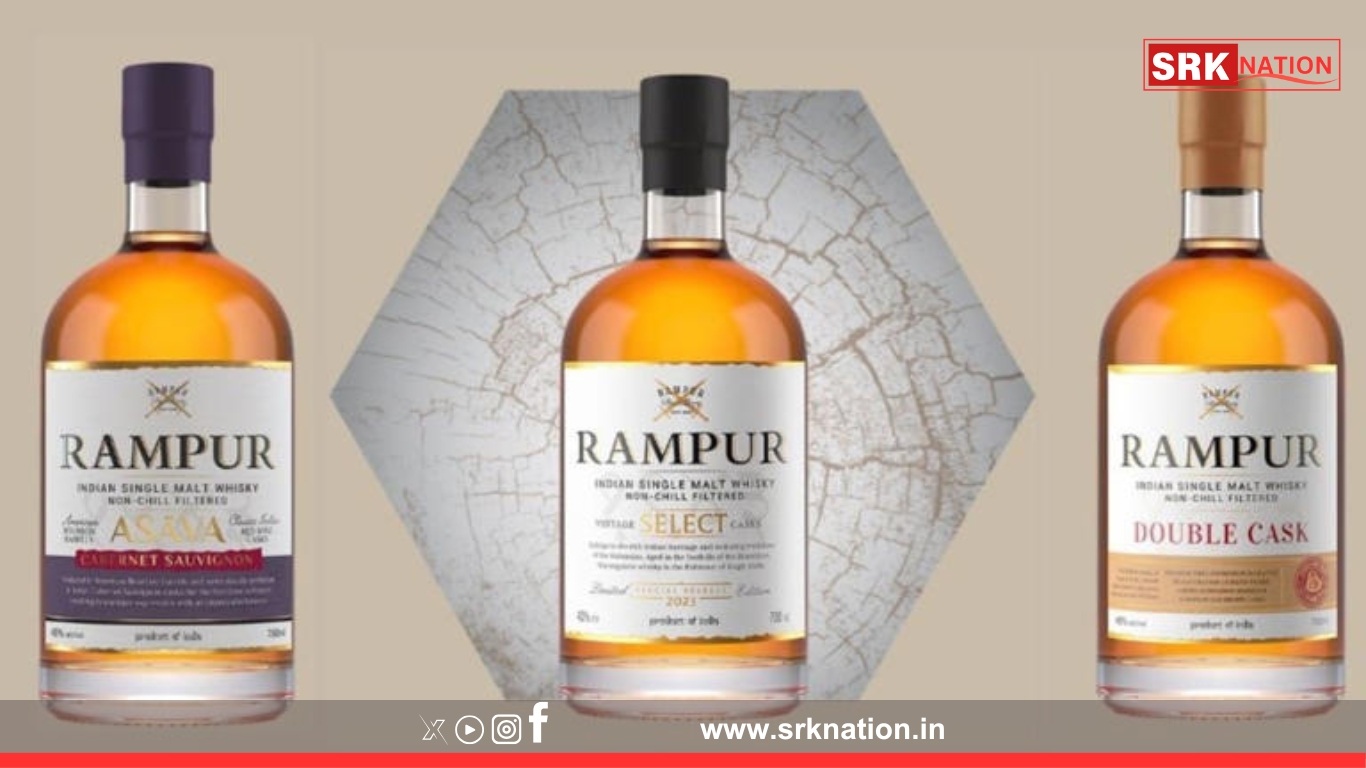

- The company plans to launch two luxury brands in Q1FY26, further strengthening its premiumization strategy.

- Radico Khaitan will also enter the super-premium whisky segment, expanding its footprint in high-growth categories.

Market Reaction & Industry Trends

- Shares of Radico Khaitan closed at ₹2,534 on BSE, reflecting investor confidence in its growth trajectory.

- The company anticipates strong double-digit growth in the Prestige & Above category, supported by robust demand in the spirits industry.